Written By: Nathan Kerr, Scott Insurance, Vice President & Affordable Housing Practice Lead

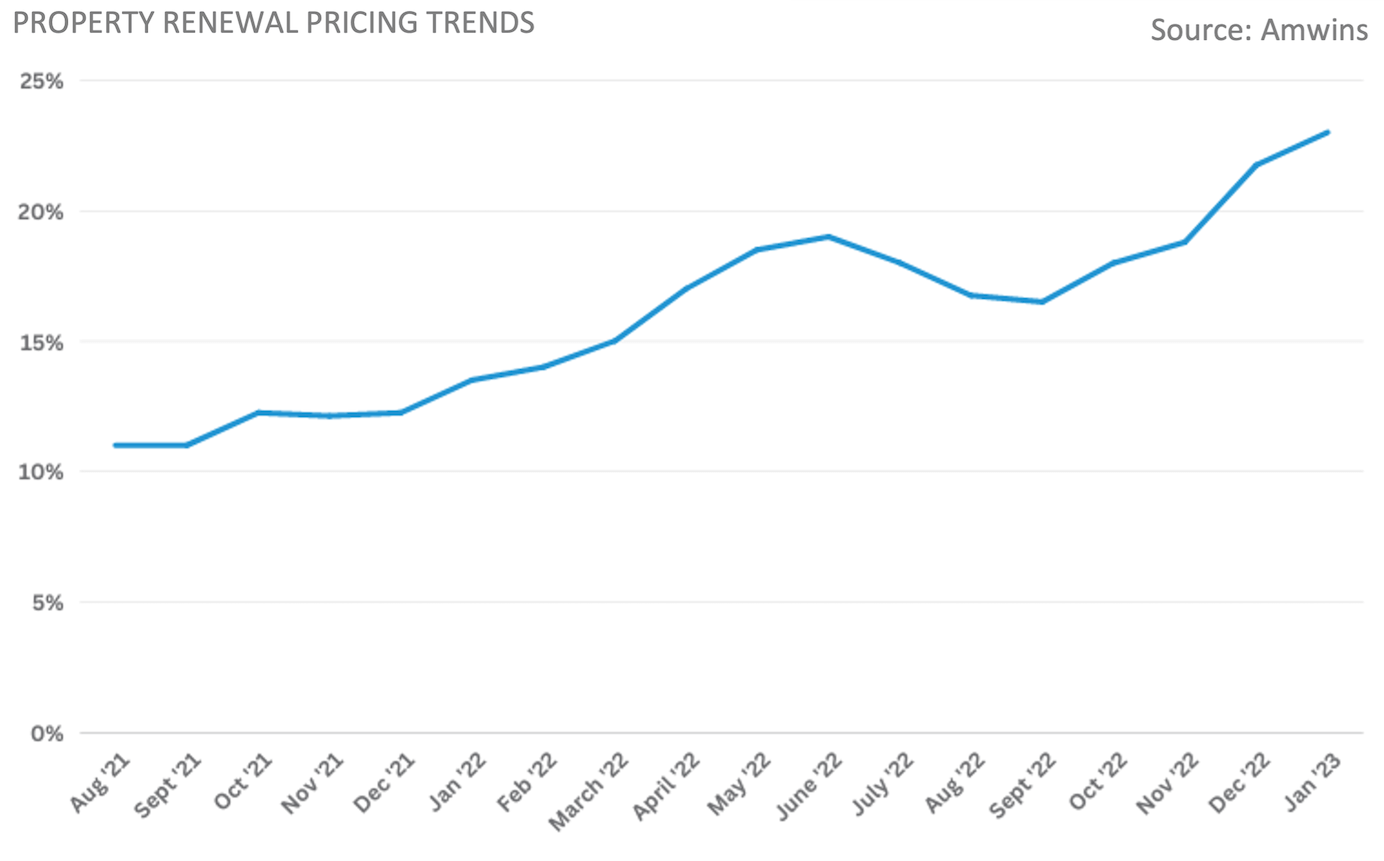

Commercial insurance rates for affordable housing organizations have continued to trend upwards since 2016. While this trend will continue for property coverage, there may be some relief for pricing, conditions and coverage capacity for some other commercial lines of coverage. Below are highlights of the expected commercial insurance market outlook for the affordable housing industry for 2023:

The property market for affordable housing organizations will continue to harden in 2023, with restricted capacity and anticipated increases in property rates and deductibles.

The property market for affordable housing organizations will continue to harden in 2023, with restricted capacity and anticipated increases in property rates and deductibles.

The casualty market for affordable housing organizations is somewhat of a mixed bag, with some challenges and some improvements.

We are seeing an increased level of competition from cyber markets eager to write new business, and we expect 2023 will bring only moderate rate increases for organizations demonstrating adequate controls. A downward trend in cyber claims through the end of 2022 will also contribute to more moderate pricing this year.

The financial and professional lines of business remain very competitive throughout the marketplace. Underwriting scrutiny will continue, however rate increases are expected to be minimal. Directors & Officers coverage is seeing flat renewals and even rate decreases in some cases.

The Scott Insurance Affordable Housing Practice Group exists to partner with affordable housing organizations to help them build the best possible insurance and risk management strategy so they can utilize more of their resources to achieve their mission of improving lives and communities. Visit www.scottins.com/affordable-housing to learn more about our specialized and dedicated Affordable Housing Practice Group.